Think Tank

Post-Pandemic Change Management: Don’t Let This Crisis Go to Waste

Photo: iStock.com/wildpixel

There is an old political saying, “Never let a crisis go to waste,” which suggests that a crisis presents opportunity.

Throughout the pandemic and beyond, suppliers and internal operational stakeholders have blamed labor shortages, fuel costs, rising commodity costs, and now inflation for their increasing costs. Most have now accepted this reasoning, to some extent, and adjusted for the additional cost in their status quo operations.

However, many organizations are missing this opportunity to rethink their operations, and utilize the crisis to drive change and cost savings. Costs that may have been prohibitive in the past may not be now, and companies may be able to establish a foundation for more efficient operations going forward.

Many companies are attacking the same challenges within material handling, warehouse and distribution operations, and facility-related costs. Building solid contracts with national providers is one way to mitigate prices, but it is equally as important to include change management in the process to maximize savings. Whether a company’s operations are sophisticated or rudimentary, there are a couple of common errors that we’ve observed.

Reactive, Rather Than Proactive, Response to Equipment Needs

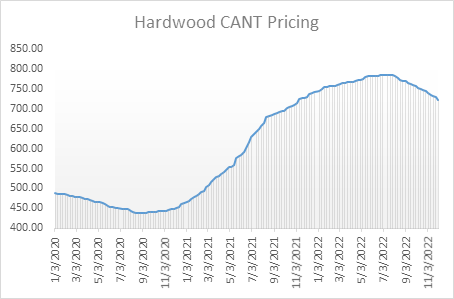

The material handling equipment industry has experienced unprecedented disruptions in its supply chains. This has led to extremely long lead times and higher costs, reflected in the index above.

Companies that are feeling this the most a) have mixed-brand fleets across multiple facilities, b) allow local facility stakeholders to make purchasing decisions resulting in dealer-level pricing, and c) have no visibility into their operational cost per hour for each individual unit within the fleet. They are being reactive to equipment needs, as opposed to proactively anticipating when equipment needs to be rotated based on their operational profile.

To develop their operational profile, companies need to look at factors such as: How many units are in the fleet? How many annual hours of use is the equipment enduring? What are the annual maintenance costs associated with each piece of equipment? What environmental factors contribute to maintenance costs? Where am I lacking visibility within the management of my equipment?

Companies then need to leverage their collective fleet size to elevate supplier relationships. Those relationships will help companies be more proactive on equipment needs and mitigate extended lead times. If running 10 or more units in a facility, or more than 1,500 hours per unit annually, companies need to consider using telematics to understand true operational costs per hour. Telematics provides insight into operational practices that can mitigate operator error and costs, while streamlining equipment use. These savings often offset the increased cost of acquiring the equipment.

Additionally, the increased costs of internal combustion models have made the switch to electric forklifts, and potentially Automated Guided Vehicles (AGVs) more feasible than in the past, and many companies are taking advantage of this solution.

Lack of Resilience in Volatile Industries

The lumber industry is notoriously volatile. Regional factors such as wildfires, invasive insects and extensive rainfall, as well as geopolitical factors such as tariffs, can cause drastic fluctuations in the cost of lumber which directly impacts the pallet industry.

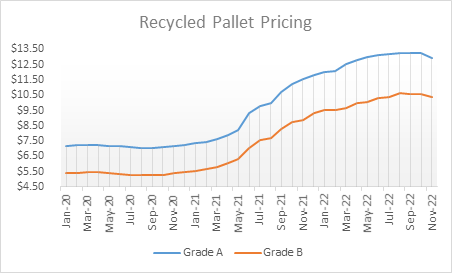

During the pandemic, companies were scrambling unilaterally to stockpile product. With an increased number of pallets sitting on racking, this shortage contributed to the existing regional operational challenges pallet manufactures were facing. New and used pallets saw the highest price increases in the pallet industry’s 30-year recorded history. It doesn’t help that pallet manufacturing industry is highly fractured, resulting in most companies allowing local facilities to manage their own relationships.

Companies who have navigated this best have succeeded in a few instances. First, they have consolidated supply, relying on as few primary and secondary pallet providers as possible for their facilities. This helps increase a business’ significance to their respective suppliers, and ensures supply security. Second, these companies are very good at forecasting. Those that can forecast well and make orders in advance never fail to receive product. Those that were placing increased orders in real time were placed on allotment, and thus subject to the going market rate.

Upstream and Downstream Factors

When considering pallets, companies should also look at their total unit cost per pallet, which includes individual packaging items and its configuration on the pallet. Most successful companies started much smaller than where they are today, but they don’t always revisit the decisions and best practices that were made in the beginning.

Every company should have detailed engineered drawings of packaging that have been approved by a company stakeholder. Too often, we see companies have obsolete drawings that are not representative of the packaging they are currently using, or even worse, no drawings at all. This is indicative of a distinct lack of visibility.

Additionally, product configuration on a pallet has upstream impacts with storage costs, as well as downstream logistical shipping costs. Total unit cost design should incorporate all these factors as savings may appear from reduced outbound shipping costs or reduced operational costs in storage. There have been many advancements and innovations in the packaging space which allow companies to potentially reduce the total unit cost per pallet, even though individual components in the packaging and pallet market have actually risen.

The Bottom Line

The truth is none of these change management initiatives are easy. For more than a decade prior to the pandemic, the economy was strong and supply disruptions were non-existent. Price point became the major component in defining value and determining business relationships. Local general managers or plant managers were entrusted to manage their own relationships and make their own buying decisions.

Often operational factors were presented as barriers to corporate consolidation efforts. All of these things supported maintaining the status quo. The pandemic’s impact was larger than any one facility could mitigate, which exposed flaws within individual company operations.

The successful companies will not let this crisis go to waste — they will implement change management practices that mitigate price increases in the short term. Then, once the market normalizes, they will have streamlined, optimized and added visibility which, along with consolidated spend, will perfectly position them in the market to go after lower prices.

Matt Williams is senior director, material handling and facilities, at CoreTrust.